Are you looking for fun and interactive ways to teach your kids about finance? Look no further!

In this article, we will explore the importance of financial literacy for children and how you can introduce them to the world of money management through engaging money games. By teaching your kids about finance at a young age, you are setting them up for a lifetime of financial success.

Financial literacy is an essential skill that every child should learn, as it empowers them to make informed decisions about their money. Teaching your kids about saving money, budgeting, and making wise financial choices not only helps them develop good habits but also instills a sense of responsibility in them.

By introducing basic concepts of investing and teaching them about earning and spending, you are equipping your children with the tools they need to navigate the complex world of personal finance. Join us as we explore some fun money games that will make learning about finance an enjoyable experience for both you and your kids!

The Importance of Financial Literacy

You need to understand the importance of financial literacy so that you can navigate the complex world of money with confidence and make informed decisions for your future.

Financial literacy is not just about knowing how to balance a checkbook or save money. It’s about having a deep understanding of how money works, including concepts like budgeting, investing, and managing debt.

By being financially literate, you gain control over your financial well-being. You can make better choices when it comes to spending, saving, and investing your hard-earned money. Financial literacy empowers you to set goals and work towards them, whether it’s buying a house or starting a business.

Without this knowledge, you may find yourself making impulsive decisions that lead to debt and financial instability.

Furthermore, financial literacy gives you the confidence to navigate through life’s unexpected challenges. Whether it’s dealing with an emergency expense or planning for retirement, having a solid foundation in financial literacy allows you to make informed decisions that align with your long-term goals. It also helps protect you from scams and predatory practices by equipping you with the knowledge needed to identify red flags and make wise choices.

Understanding the importance of financial literacy is crucial for navigating the complex world of money confidently. It enables you to make informed decisions that align with your goals while protecting yourself from potential pitfalls.

By becoming financially literate, you join a community of individuals who take charge of their financial futures and create opportunities for themselves and their families. So start learning about personal finance today and empower yourself for a prosperous tomorrow!

Teaching Kids about Saving Money

Start by showing your children how to set aside a portion of their allowance or earnings for future use. This is an important lesson in teaching kids about saving money.

Explain to them the concept of saving for something they want, whether it’s a toy, a game, or even a bigger goal like going on a family vacation. Encourage them to allocate a certain percentage or amount from their income each time they receive it.

To make the process more enjoyable and relatable for your kids, try incorporating these fun activities:

-

Create savings jars: Get some clear jars and label them with different categories, such as ‘spending,’ ‘saving,’ and ‘charity.’ Whenever your child receives money, have them divide it into these jars accordingly. This will help them visually see how much they are setting aside for future use.

-

Set savings challenges: Challenge your kids to save a certain amount within a given timeframe. For example, if they save $10 within two weeks, you can reward them with an extra treat or privilege. This will motivate them and make saving money feel like an exciting game.

By teaching kids about saving money from an early age, you’re instilling valuable financial habits that’ll benefit them throughout their lives. It’s important to explain why saving is essential – how it allows us to be prepared for unexpected expenses and achieve our goals. By making the learning process engaging and relatable through fun activities, you can ensure that your children develop good saving habits while also enjoying the journey towards financial independence.

Introducing Budgeting to Children

Imagine taking your child on a journey, where they become the captain of their own ship and learn how to navigate through the waters of budgeting. Introducing budgeting to children is an essential step in teaching them about financial responsibility. By giving them control over their own money and showing them how to allocate it wisely, you’re setting them up for success in the future.

Start by explaining what a budget is and why it’s important. Teach your child that a budget is simply a plan for how to spend and save money. Show them how to track their income, whether it’s from allowances or small jobs around the house, and then help them allocate that money into different categories such as saving, spending, and donating.

Next, encourage your child to set goals for themselves. This could be saving up for a new toy or gadget they’ve been eyeing or even putting money aside for a family vacation. By having something tangible to work towards, they’ll be motivated to stick with their budget.

Make sure to regularly check in with your child about their progress. Sit down together and review their spending habits, discuss any challenges they may have faced along the way, and offer guidance on how they can improve. This not only helps them stay accountable but also allows you to provide valuable lessons about financial decision-making.

By introducing budgeting at an early age, you’re equipping your child with lifelong skills that’ll serve them well in adulthood. They’ll learn the importance of making wise financial choices and develop good habits that’ll last a lifetime. So set sail on this adventure together and watch as your child becomes a skilled navigator of their own financial future!

Making Wise Financial Decisions

Take your child on a journey towards financial success by learning how to make wise decisions with their hard-earned cash. Teaching them about making smart financial choices at a young age will set them up for a lifetime of economic security.

Here are three key principles to instill in your child when it comes to making wise financial decisions:

-

Delayed gratification: Teach your child the importance of patience and delaying instant gratification. Help them understand that saving money and waiting for something they really want can be much more satisfying than impulsively spending on temporary pleasures. Encourage them to set goals and save up for big-ticket items, such as a new toy or video game, so they can experience the joy of achieving their goal through disciplined saving.

-

Opportunity cost: Introduce the concept of opportunity cost to your child, which means considering what they are giving up when they spend money on one thing instead of another. Help them evaluate trade-offs and think critically about whether their purchase is worth sacrificing other potential options. By understanding this principle, children can learn to prioritize their spending based on value and long-term benefits rather than immediate desires.

-

Research before buying: Teach your child the importance of doing research before making purchasing decisions. Encourage them to compare prices, read reviews, and consider alternatives before spending their money. This will help develop their critical thinking skills and empower them to make informed choices instead of impulsive purchases. Emphasize the importance of being an informed consumer who makes thoughtful decisions based on value and quality.

By imparting these principles early on, you’re equipping your child with essential skills that’ll contribute to their financial well-being in the future. Remember, teaching kids about finance isn’t just about numbers; it’s about building a foundation for responsible decision-making that’ll benefit them throughout their lives.

Instilling a Sense of Responsibility

Instilling a sense of responsibility in children involves guiding them towards making thoughtful and informed decisions about their financial choices, laying the groundwork for a secure financial future. By teaching your kids to understand the value of money and the importance of making responsible decisions, you’re equipping them with essential life skills that’ll serve them well as they grow older.

One effective way to instill this sense of responsibility is by giving your children opportunities to make their own financial decisions within certain boundaries. Start by giving your kids an allowance or pocket money and encourage them to allocate it wisely. Teach them about budgeting and saving, explaining how setting aside a portion of their money can help them achieve long-term goals. Help them create simple budgets for things they want, such as toys or outings with friends.

By allowing them to make choices within these parameters, you’re helping them develop decision-making skills while also cultivating a sense of ownership over their finances.

Another important aspect of instilling responsibility in children is teaching the consequences of their actions when it comes to money. If your child spends all their allowance on small purchases early in the week, they’ll have nothing left for bigger items later on. Encourage them to think ahead and consider the potential outcomes of different financial decisions. This helps foster critical thinking skills and encourages a proactive approach towards managing money.

Instilling a sense of responsibility in children regarding finance is crucial for their future success. By providing opportunities for decision-making within set boundaries and teaching the consequences of actions, you’re empowering your kids to become financially responsible individuals. These lessons will not only set the foundation for their personal finances but also contribute to their overall development into mature adults who can confidently navigate the complexities of the financial world.

Teaching Kids about the Value of Money

Now that your kids understand the importance of responsibility, it’s time to teach them about the value of money. This is a crucial lesson that will help them develop a healthy relationship with finances as they grow older. By teaching them about the value of money, you’ll be equipping them with the knowledge and skills they need to make smart financial decisions in the future.

One way to teach kids about the value of money is by giving them an allowance. This gives them a sense of ownership over their finances and teaches them how to budget and save. Encourage your children to set financial goals, whether it’s saving up for a new toy or contributing towards a family vacation. By working towards these goals, they’ll learn the value of delayed gratification and how saving can lead to bigger rewards in the long run.

Another effective method is involving your kids in real-life financial situations. Take them grocery shopping and show them how prices vary for different items. Teach them about sales, discounts, and coupons, and explain how being mindful of these factors can help stretch their money further.

Additionally, encourage your children to participate in activities like yard sales or lemonade stands where they can earn their own money. These experiences will give them firsthand knowledge on how hard work translates into earning money.

By teaching your kids about the value of money at an early age, you’re setting them up for success in adulthood. They’ll develop important skills such as budgeting, saving, and making informed purchasing decisions. Remember that learning about finance doesn’t have to be boring; make it fun by incorporating games or challenges that involve money management skills. With this knowledge under their belt, your children will have a strong foundation for managing their finances responsibly throughout their lives.

Introducing Basic Concepts of Investing

Once you’ve laid the groundwork for financial responsibility, it’s time to dive into the exciting world of investing and watch your children’s money grow exponentially. Introducing basic concepts of investing at a young age can help set them up for future financial success. Investing teaches kids about the value of patience, risk management, and delayed gratification.

To make learning about investing more fun and interactive, you can use a simple table to explain different investment options and their potential returns. In the first column, list common investment types such as stocks, bonds, and real estate. In the second column, describe each investment type briefly and explain how they work. For example, stocks represent ownership in a company while bonds are loans made to governments or corporations. Lastly, in the third column, showcase historical average returns for each investment type over a long-term period. This will give your children an idea of how their money could potentially grow over time.

By introducing basic concepts of investing early on, you’re giving your children valuable knowledge that will benefit them throughout their lives. They’ll learn that saving money alone may not be enough to build wealth; it’s important to put those savings to work through investments. As they watch their money grow over time, they’ll develop a sense of pride and accomplishment knowing that they’ve made smart financial decisions. Teaching kids about investing not only helps them become financially savvy individuals but also fosters a sense of belonging within a community that values smart money management.

Teaching Kids about Earning and Spending

From a young age, you can help your children develop a strong work ethic and learn the value of their earnings by engaging them in activities that allow them to earn and spend their own money. By doing so, they’ll gain a sense of responsibility and understand the concept of working for what they want.

Encourage them to take on small jobs around the house or neighborhood, such as mowing lawns, walking dogs, or doing chores for family members. This will not only teach them about earning money but also instill in them the importance of hard work.

Once your children have earned some money, it’s important to guide them on how to wisely spend it. Help them create a budget and set goals for saving and spending. Teach them about different categories such as essentials like food and clothing, savings for future goals or emergencies, and discretionary spending for things they may want but don’t necessarily need.

By teaching kids about these concepts early on, they’ll develop good financial habits that’ll serve them well later in life.

In addition to earning and spending money responsibly, it’s essential to teach your children about giving back. Encourage them to donate a portion of their earnings to charities or causes that are meaningful to them. This helps foster empathy and generosity while teaching kids that money can be used not just for personal gain but also for making a positive impact on others’ lives.

By engaging your children in these activities from an early age, you’re setting a foundation for financial literacy and responsible money management that’ll benefit them throughout their lives.

Fostering Independence in Money Management

To foster independence in managing their finances, you can encourage your children to create their own monthly budget. This allows them to allocate their earnings towards various expenses and savings goals. Did you know that 68% of teenagers who manage their own money are more likely to develop good financial habits?

Creating a monthly budget empowers children by giving them control over their own money. They can learn about the importance of setting financial goals and making wise spending decisions. With a budget, they can prioritize their expenses and decide how much money they want to allocate for different categories such as saving for a new toy, contributing to charity, or even starting a small business. This exercise not only teaches them the value of money but also instills responsibility and discipline.

By involving your kids in the process of creating a monthly budget, you are teaching them crucial life skills that will benefit them in the long run. Here are three items you can include in your child’s budgeting experience:

-

Allowance: Determine an appropriate allowance for your child based on their age and responsibilities. This provides them with income they can manage.

-

Fixed Expenses: Help your child identify fixed expenses such as school supplies or extracurricular activities that require regular payments. This helps teach them about recurring obligations.

-

Savings Goals: Encourage your child to set savings goals for things they really want or future aspirations like college or travel. This helps cultivate patience and delayed gratification.

Remember, fostering independence in money management not only prepares your children for financial success but also gives them confidence in making sound decisions with their hard-earned money. By engaging them early on with real-life scenarios through a monthly budget, you provide valuable lessons that will shape their financial habits well into adulthood.

Additionally, instilling the importance of saving and investing from an early age will empower them to create a secure financial future and achieve their long-term goals.

Fun Money Games for All Ages

Now that you’ve learned about fostering independence in money management, let’s dive into some fun money games that you can play with your kids to teach them about finance. These games are not only educational but also enjoyable, making the learning process much more engaging for children of all ages.

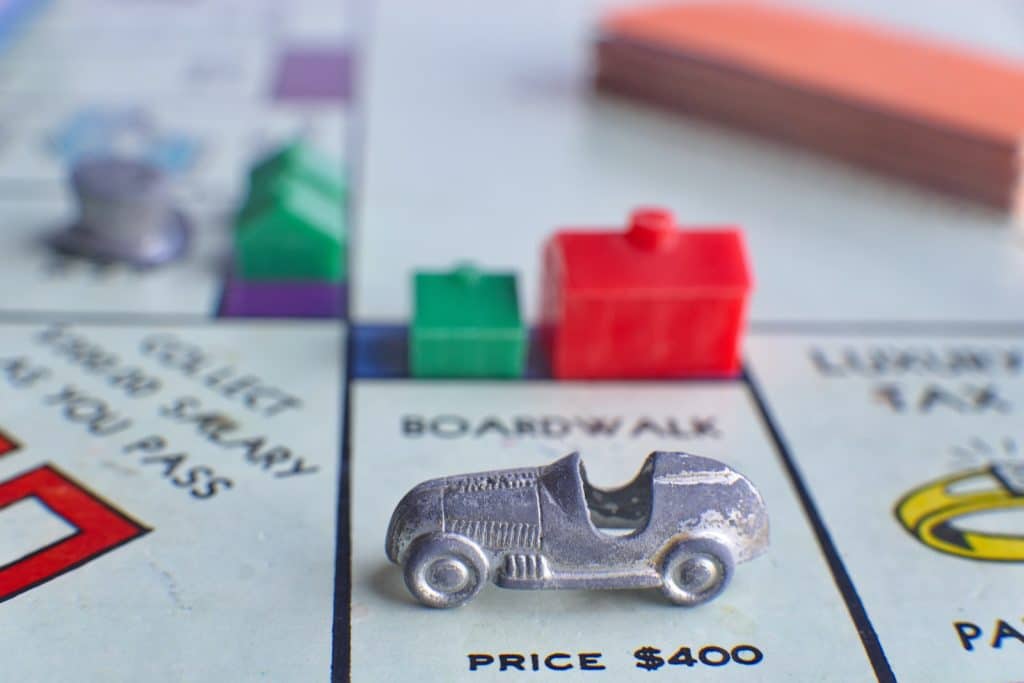

One popular game is ‘Monopoly.’ This classic board game allows kids to experience the ups and downs of buying and selling properties, paying rent, and managing their money. As they navigate through the game, they’ll learn important financial concepts such as budgeting, negotiation skills, and decision-making. It’s a great way to introduce your kids to the world of finance in a fun and interactive manner.

Another exciting game is ‘The Game of Life.’ In this game, players go through different life stages, making career choices, paying taxes, investing in stocks, and handling unexpected expenses. It offers a realistic simulation of real-life financial situations and helps kids understand the importance of planning for their future. By playing this game together as a family, you can spark conversations about saving money for retirement or investing in education.

Lastly, there are various online games available that focus specifically on teaching kids about personal finance. These games often incorporate elements of gamification to make learning enjoyable while covering topics like budgeting, saving money for goals, avoiding debt, and understanding interest rates. They provide an interactive platform where children can practice making financial decisions without real-world consequences.

By incorporating these fun money games into your family time, you’ll not only be providing entertainment but also instilling valuable financial knowledge in your children. Remember to use these games as opportunities for open discussions about finances so that your kids can ask questions and gain a deeper understanding of how money works.

So gather around the table or hop on your devices and start playing these educational yet entertaining games with your little ones today!

Frequently Asked Questions

How can I teach my child about the importance of financial literacy?

Teaching your child about the importance of financial literacy is crucial for their future success. By instilling these skills early on, you’re setting them up for a lifetime of financial stability and independence.

Start by explaining basic concepts such as saving, budgeting, and the value of money. You can use real-life examples like giving them an allowance and encouraging them to save a portion of it.

Introduce them to the idea of setting financial goals, whether it’s saving up for a toy or contributing towards a family vacation. Engage in conversations about needs vs. wants, teaching them to differentiate between essential purchases and impulse buys.

Additionally, involve them in everyday activities like grocery shopping or comparing prices online so they understand the importance of making informed decisions.

Remember to make learning about finance fun by incorporating games and activities that simulate real-world scenarios. By doing so, you’ll not only teach your child the significance of financial literacy but also empower them to make smart money choices throughout their lives.

Additionally, engaging in practical exercises such as budgeting challenges or investment simulations can help your child develop essential financial skills and gain confidence in managing their money effectively.

What are some effective ways to introduce budgeting to children?

Introducing budgeting to children can be a challenging task, but it’s essential for their financial literacy.

One effective way to do this is by turning budgeting into a game. Imagine taking your child on a thrilling adventure through the world of money management, where they’re the heroes and every decision counts.

By creating a fictional scenario or using real-life examples, you can engage their imagination and make learning about budgets fun and exciting. Encourage them to set financial goals, allocate funds for different purposes, and track their spending.

Instilling these skills early on will empower your child with the knowledge they need to navigate their financial future successfully. It’ll also foster a sense of belonging as part of a financially savvy community.

Are there any specific games or activities that can help teach kids about making wise financial decisions?

There are indeed specific games and activities that can help teach kids about making wise financial decisions. One popular game is ‘Monopoly,’ which teaches children about buying, selling, and managing money through the concept of property ownership.

Another fun game is ‘The Stock Market Game,’ where kids can learn about investing in stocks while competing against their friends or classmates.

Additionally, you can try playing ‘Cashflow for Kids,’ a board game that simulates real-life financial situations and challenges players to make smart financial choices.

These games not only provide an entertaining experience but also effectively educate children on the importance of making wise financial decisions from a young age.

How can I instill a sense of responsibility in my child when it comes to money management?

To instill a sense of responsibility in your child when it comes to money management, it’s important to start by teaching them the value of money and the importance of making wise financial decisions. You can do this by involving them in age-appropriate discussions about budgeting, saving, and spending wisely.

Encourage them to set goals for their savings and help them create a plan to achieve those goals. Additionally, give them opportunities to earn their own money through chores or other tasks so they can learn the value of hard work and the satisfaction that comes from earning and managing their own funds.

By providing guidance and setting a good example yourself, you can help your child develop responsible money habits that will benefit them throughout their lives.

Are there any fun money games that are suitable for different age groups?

There are indeed fun money games that are suitable for different age groups!

For younger kids, you can start with simple activities like playing ‘store’ or ‘restaurant,’ where they can pretend to be the cashier and handle play money.

As they get older, board games like Monopoly or The Game of Life can introduce concepts of buying property, managing finances, and making decisions based on budgeting.

Online games and apps such as Moneyville or Peter Pig’s Money Counter offer interactive ways to teach kids about earning, saving, and spending money.

Additionally, there are card games like Cashflow for Kids that simulate real-life financial scenarios and encourage strategic thinking.

These games not only make learning about finance enjoyable but also instill important skills that will benefit children throughout their lives.

Conclusion

In conclusion, teaching your kids about finance through fun money games is like planting seeds of financial wisdom in their young minds.

Just as a small seed eventually grows into a strong and sturdy tree, these lessons will provide a foundation for your children’s future financial success. By instilling the importance of saving, budgeting, and making wise decisions, you’re equipping them with the tools they need to navigate the complex world of finance.

Imagine your child soaring through life like an eagle, confidently managing their money and making informed choices. By introducing basic concepts of investing and teaching them about earning and spending, you’re empowering them to take control of their financial destiny.

As they grow older and face financial challenges, they’ll have the knowledge and skills to overcome any obstacles that come their way.

So why not start today? Engage in fun money games with your kids that foster independence in money management. Watch as they blossom into financially responsible individuals who can handle any storm that comes their way.

Remember, just as the mighty oak stands tall amidst turbulent winds, so too will your children stand strong in their financial journey with the guidance you’ve given them through these enjoyable activities.

In conclusion, by playing fun money games with your kids and immersing them in the world of finance from an early age, you’re setting them up for a prosperous future. These games serve as stepping stones on their path to financial literacy and independence.

So let’s embark on this exciting adventure together!